Ramble #81

Hi Team,

Welcome to the latest edition of Ramble, a compilation of what I have been pondering, learning and enjoying for the past few weeks.

Now, grab a beverage and let’s begin.

Something Interesting:

Don't be fooled by the Mercator Projection:

It is named after Gerardus Mercator after he presented his projection in 1569.

Unfortunately, transferring a cylindrical projection of a spherical earth on to a flat page results in significant distortion, by inflating the size of land massess proportional t0 their distance from the equator.

What I am Reading:

Not a self-help or human optimisation how-to-get things done book.

Rather, it is a "take 'solace' (not sure that is the right word) in the fact that you will never get your to-do list finished, you will never have enough time, there will always be another issue vying for your attention and eventually you will die before ever having achieved all the things you want to achieve; so relax and enjoy the ride..." kind of book.

This was literally forced into my hands by the staff of a local bookstore with breathless recommndations around "...the book of the year..."

It was pretty good - psychological crime thriller with lots of complex characters by a top tier writer.

An excellent holiday read.

Very McCarthy (who I think is nearly 90 at this point) - simple, violent and sparse. Like many of his stories, mostly set in the American south with themes of hardship and quiet stoicism.

The companion piece to 'The Passenger', it reads as the case notes between a disturbed young woman and her Psychiatrist. Quite a weird novel, but still felt compelled to finish it for some reason...

"...if a worker wants to take time off to recover from the flu, they need to notify their employer of this days before actually catching the virus. Given that workers’ contracts do not include paid psychic benefits, this is a tall order."

"That strategy is predicated on treating rail workers as if they were nearly indistinguishable from the railcars they drive. The typical railcar requires maintenance at predictable intervals and does not require an unanticipated day off to see a doctor about an unexplained pain or to visit a loved one in the hospital. But workers often do."

"The injured tiger hunted Markov down in a way that appears to be chillingly premeditated. The tiger staked out Markov's cabin, systematically destroyed anything that had Markov's scent on it, and then waited by the front door for Markov to come home."

What I am Watching:

- Triangle of Sadness

A scathing review of the rich and famous, beautiful and influential. Very much a 'film festival' flick.

Also - Woody Harrelson.

- Glass Onion: A Knives Out Mystery (Netflix)

Loved the first movie. The sequel is excellent. Daniel Craig is doing a fantastic job with his Benoit Blanc character. And 'who dunnit' movies led by 'the mysterious detective' are always entertatining.

Also its another movie making fun of super rich fools.

And there's Hugh Grant.

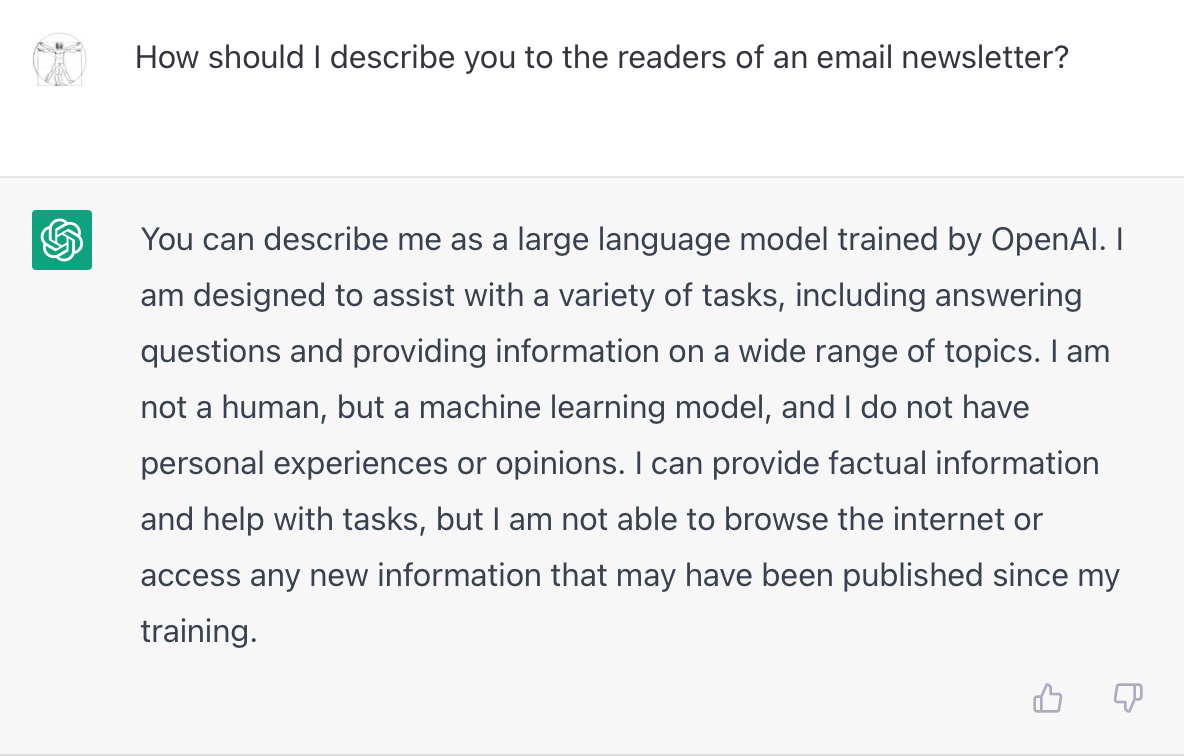

Cool Thing in Technology:

The whole Artificial Intelligence space continues to crack along with ChatGPT released by OpenAI recently.

For example:

Try it out.

Describe your boss to it and ask it to write an email from your boss to management proclaiming how amazing you are (for fun purposes only, of course...).

Or ask it to write some sort of school-level essay for you - the place of bushrangers in Australian history or something. And consider how it will change acadaemia.

It's fun. And a bit worrying.

Travel Planning:

In the next installment of -

"How to Quit Your Job and Escape for a Year (and Why You Should...)"

- Part 1 - How to Quit Your Job; Section d) - Save

I have added this to the original growing document HERE.

"The hardest part is done. You have decided to escape. You are in a profession in which you can progress and build a career to which you can return. The people around you will gladly see you return to your role. But they don’t even know that you are going yet, because you have successfully followed the furst rule and not told anybody.

Now to saving.

Quietly.

Naturally, if there is no difference between your income and your expenses then there is no mathematical way to save anything.

But you have a good job, within which you are progressing in your career. So the income side of things should be fine.

Check your spending by documenting it for a couple of pay cycles - you can use a spreadsheet or one of any number of apps. I used pocketbook for a long time before it was discontinued but alternatives include Frollo, Buddy, YNAB and the expense tracking features that some of the big banks are starting to include in their own native mobile apps.

Once you have done this, recovered from any shock that you need to recover from, you can move on.

First move on to cutting any ridiculous expenses that you may have noticed. Then move on to saving.

The aim is to pay yourself first. 'Paying Yourself' means transferring a set amount of money from your salary every week/fortnight into a specific account slated specifically for your escape.

As. Soon. As. You. Get. Paid.

And then not spending it.

Then you pay your bills and other expenses with whatever is left over.

That's it.

Relax, you won't turn into a scrooge who sits at home unable to have any fun because you have run out of money. You have a good job. It pays well. You'll be fine.

If you do not spend any of your 'Escape Money' by the end of the pay cycle, even if you are just scraping through to the next pay day, then the maths becomes simple.

If you allocate $1000 every fotnightly pay cycle to your travel savings, you will save $26,000 per year.

Every year.

Again, thats it.

So long as you actually save the difference between income and expenses (both survival rent/groceries expenses and fun expenses) every pay cycle, its just a matter of time until you save whatever amount you need to Escape.

We will discuss how much you need in the next instalment."

I really do think it is that simple. But, at the risk of getting too complcated, I suppose there are some extra strategies.

Some Extras

Not much more to it then that.

2. Declare It

Give your dedicated savings account a name like “War Chest” or “Escape Money” or "Freedom Fund". If you ever take money out of it to pay for something discretionary, you will know that that just cost yourself a week in Thailand, or a couple of nights on a riviera somewhere.

Yeah, it's dorky. But that extra week in Thailand is not...

3. Inertia

Build in some inertia to help.

Everyone these days has ING accounts after reading The Barefoot Investor, which may be one of the most impactful documents ever written by any Australian in history.

But storing your Escape Money in a separate ING account with access to instantaneous transfers to your 'Daily Expenses' card account is a recipe for spending little chunks of your Escape Money every fortnight.

When you "only spend $50" from your Freedom Fund when out with the boys with promises to "replace it with an extra $50 when I next get paid" - you are just lying to yourself.

And cheating yourself out of an Escape.

Put your Escape Money in a totally separate bank. Ideally one without these instantaneous 'Osko' transactions between banks - which admittedly UBank has introduced - and which I have been using for years.

Earlier on, I was using Raiz to build in up to 5 days delay into cashing out any travel money given that it is held by a third party who has invested your money into the sharemarket. I placed regular 'deposits' into the lowest growth (read: risk) portfolio they offered. And knew that I could never have that money back in an 'emergency' because it would take a few days for them to 'sell my shares' and cash out my funds. This worked very well.

Raiz, along with other investment platforms including Pearler, also offer roundup services - which is another sneaky way of saving a bit more cash every pay cycle.

Given that I am well within 12 months of departure at the time of writing, I do not have a single dollar exposed to the stock market. If you have years of saving ahead, consider something simple like this - not for making any money in the stock market at all (assume you will make none), rather for the time it takes to get it out, so that you can't spend it on a whim - just to be clear.

4. No Credit Cards...yet

Perfectly filling your War Chest while living a fun life would have your discretionary spending bank account showing $0 by 11:59pm on the night before you are paid.

(You will still have money in your separate 'Mojo' account for actual emergencies - come on. If you don't know what I'm talking about, hurry up and ready the Barefoot Investor.)

This progressive dwindling of your discretionary spending amount each week is important. You can see exactly how much left you can spend before you will either have to wait until you are paid or start dipping into your Freedom Fund.

So there is a built in pressure to not do anything dumb, make it to the next pay cycle, and keep you Escape Money growing.

Credit card statements read the other way. They go up. They just don't have the built in pressure of a number approaching zero to clear you mind and sway you from buying something stupid.

Credit cards will enter the story later...

Recent Travel:

We spent the week over Christmas on Heron Island -

It looks like this.

It was amazing.

Summary to come soon.

Tool I am Trying:

I upgraded my in car phone charging system from cigarette lighter-to-USB adapter-to-cord-with phone sliding around passenger seat to something much more sensible.

I went for a new Quadlock case with a suction windscreen mount and wireless charging head.

It works well and the case itself is worth it for the quality.

Side note: Quadlock (I think is Australian) has an excellent order flow and absolutley must be doing well.

Closing Thoughts:

Thank you once again for reading along with me.

If you found something you liked, let me know.

If you think I can do something a little smoother, please let me know.

Talk soon.

Luke.