How to Quit Your Job and Escape for a Year (and Why You Should…)

Updated: 4/6/23

I am encouraging everyone to quit and go travelling. So I should probably have something to tell them.

Caveat - These will be reflective of my thinking and planning - ie went to uni for too long, got a good job as a doctor (pays well, yeah, but it's a career that takes some planning to step out of), married, no mortgage, no kids, no pets (by design, for literally this purpose)...

I want to make this clear because generalising advice like this such that it applies to everyone would be to smear it so thin that it could never apply to anyone.

So I will tell you specifically what I have done and won't feel bad if it doesn't perfectly line up with your particular circumstances. Rant done.

So - "How to Quit Your Job and Escape for a Year (and Why You Should...)"

Part 1 - How to Quit Your Job; Section a) - Don't Tell Anyone

If you feel the need to escape, first don’t tell anyone. Sure, tell your person. But don't discuss it with anyone else.

This is almost like that first rule of Fight Club...

Don't tell anyone.

Don't bring up "I had the thought of maybe going..." at parties. Don't ask the advice of your extended friend group. They very likely won't support your effort to escape. Rather they will sincerely support you to "go for that promotion at work", or "just do it, put a deposit on that house you've been looking at" or whatever. All sincerely, of course. But potentially poisonous to your efforts to escape. At worst, some of your friends will be jealous of your plans and desperate for you to remain unhappy and under-fulfilled with them...at Friday drinks...every Friday...discussing interest rates and childcare costs...and sportsball...forever.

And definitely don't discuss it at work. This will become important later. Because as soon as you do, you will find more reasons not to escape. Just as you are at the very beginning of an idea, just starting to mull it over, before the idea has even fermented a little, some middle management type will say something like “oh just do it later in your career when you are a bit more settled” and you will. And by then, life and career and osteoarthritis will have taken over, and you will never escape (or at least this should be your working assumption).

So, again, the first rule of quitting your job and escaping is "don't tell anyone"...

Part 1 - How to Quit Your Job; Section b) - Get a Good Job

Once you have had the thought that escaping might be nice, and not told anybody, you will need a good job to fund it.

'Good' should mean a few things here:

- Roughly in your field of interest. You need to be able to willingly trade time for money for this period - soul crushing labour is not sustainable.

- Scope for career progression is broad.

- Job security is high.

- Your role is well-defined.

- You are paid to the level of a skilled professional. (This does not imply you have a University Degree...)

- Leave can be accrued. (This will become important later)

Think government bodies like health or industry. Some of the big private firms. Universities. etc

Examples -

University Requirement: Nursing - Incredible job security and demand for labour; career progression is clear and broad into multiple specialties and levels of seniority; good pay (penalty rates) for skilled work; and leave can be accrued within a health service.

No University Requirement: Trades - Think Carpentry or Plumbing - This would need to be within a larger company with scope for progression through levels of seniority and options for leave accrual; high job security; skilled labour that demands a premium; low competition against incoming tradesmen not committed to doing 'good work'.

I don't care how you Get the Job, but for the love of all that is holy, don't tell anyone your plans in the job interview. And if you already have a job, ensure it is a 'Good' one per the above criteria.

Don't worry, if you are interviewing for a job you are not lying by omission. Because at this point, you are literally at step 1-b of the plan. You couldn't tell anyone where you are going or when you are leaving if your life depended on it.

Just Get a Good Job first.

Part 1 - How to Quit Your Job; Section c) - Do Good Work

You have decided you are going to escape. And told no one. You have found a good job. Now, do good work.

Your next 2-4 years of working (saving) is also your CV for your return. Don’t be a burden. Do good work. When you are at work, be an excellent employee. Ruffle as few feathers as possible, but be good at your job such that you are valuable. Make yourself valuable enough that you would have no problem applying for your own job when you return (or before you even leave...more on that later).

Do not be the one putting in after hours unpaid time. That is not helping you escape. You could maybe argue that it will help your return to a career, but what kind of career is that? That sounds really sucky. Just show up. Do good work. Keep quiet about your plans. Stack cash. Go home and have a fun life with the knowledge that you have an escape planned.

And, of course, don’t be a dick. It is possible to have a good job. To be saving. To be doing good work. Progressing in a career. Holding a secret. But being a dick.

Dicks don’t get their job back. And that will be important soon.

Part 1 - How to Quit Your Job; Section d) - Build Relationships

You are doing good work. But you need to build relationships.

This stage locks in your job for when you return. You are already working in your field of interest, and doing a good job at it. This is the time to start connecting with those people who actually make decisions. The boss of your department, unit, service line or whatever your industry's hierarchical structure looks like.

There is no need for disgusting sycophancy here. Simply being a serious adult, doing good work, telling another serious adult that you would like to progress in your shared field is usually enough to seal the deal.

To lock it in, just teach others in your field and put some effort in to professional development and bettering your department - in work hours of course.

By doing this, building relationships for a couple of years, you will guarantee that you are not forgotten during your escape.

And it is probably enough to already lock in your own job while you go and have fun.

Part 1 - How to Quit Your Job; Section e) - Save

The hardest part is done. You have decided to escape. You are in a profession in which you can progress and build a career to which you can return. The people around you will gladly see you return to your role. But they don’t even know that you are going yet, because you have successfully followed the first rule and not told anybody.

Now to saving.

Quietly.

Naturally, if there is no difference between your income and your expenses then there is no mathematical way to save anything.

But you have a good job, within which you are progressing in your career. So the income side of things should be fine.

Check your spending by documenting it for a couple of pay cycles - you can use a spreadsheet or one of any number of apps. I used pocketbook for a long time before it was discontinued but alternatives include Frollo, Buddy, YNAB and the expense tracking features that some of the big banks are starting to include in their own native mobile apps.

Once you have done this, recovered from any shock that you need to recover from, you can move on.

First move on to cutting any ridiculous expenses that you may have noticed. Then move on to saving.

The aim is to pay yourself first. 'Paying Yourself' means transferring a set amount of money from your salary every week/fortnight into a specific account slated specifically for your escape.

As. Soon. As. You. Get. Paid.

And then not spending it.

Then you pay your bills and other expenses with whatever is left over.

That's it.

Relax, you won't turn into a scrooge who sits at home unable to have any fun because you have run out of money. You have a good job. It pays well. You'll be fine.

If you do not spend any of your 'Escape Money' by the end of the pay cycle, even if you are just scraping through to the next pay day, then the maths becomes simple.

If you allocate $1000 every fotnightly pay cycle to your travel savings, you will save $26,000 per year.

Every year.

Again, thats it.

So long as you actually save the difference between income and expenses (both survival rent/groceries expenses and fun expenses) every pay cycle, its just a matter of time until you save whatever amount you need to Escape.

We will discuss how much you need in the next instalment.

I really do think it is that simple. But, at the risk of getting too complcated, I suppose there are some extra strategies.

Some Extras

Not much more to it then that.

2. Declare It

Give your dedicated savings account a name like “War Chest” or “Escape Money” or "Freedom Fund". If you ever take money out of it to pay for something discretionary, you will know that that just cost yourself a week in Thailand, or a couple of nights on a riviera somewhere.

Yeah, it's dorky. But that extra week in Thailand is not...

3. Inertia

Build in some inertia to help.

Everyone these days has ING accounts after reading The Barefoot Investor, which may be one of the most impactful documents ever written by any Australian in history.

But storing your Escape Money in a separate ING account with access to instantaneous transfers to your 'Daily Expenses' card account is a recipe for spending little chunks of your Escape Money every fortnight.

When you "only spend $50" from your Freedom Fund when out with the boys with promises to "replace it with an extra $50 when I next get paid" - you are just lying to yourself.

And cheating yourself out of an Escape.

Put your Escape Money in a totally separate bank. Ideally one without these instantaneous 'Osko' transactions between banks - which admittedly UBank has introduced - and which I have been using for years.

Earlier on, I was using Raiz to build in up to 5 days delay into cashing out any travel money given that it is held by a third party who has invested your money into the sharemarket. I placed regular 'deposits' into the lowest growth (read: risk) portfolio they offered. And knew that I could never have that money back in an 'emergency' because it would take a few days for them to 'sell my shares' and cash out my funds. This worked very well.

Raiz, along with other investment platforms including Pearler, also offer roundup services - which is another sneaky way of saving a bit more cash every pay cycle.

Given that I am well within 12 months of departure at the time of writing, I do not have a single dollar exposed to the stock market. If you have years of saving ahead, consider something simple like this - not for making any money in the stock market at all (assume you will make none), rather for the time it takes to get it out, so that you can't spend it on a whim - just to be clear.

***Not investment advice, obviously.

4. No Credit Cards...yet

Perfectly filling your War Chest while living a fun life would have your discretionary spending bank account showing $0 by 2359 the night before you are paid.

(You will still have money in your separate 'Mojo' account for actual emergencies - come on. If you don't know what I'm talking about, hurry up and ready the Barefoot Investor.)

This progressive dwindling of your discretionary spending amount each week is important. You can see exactly how much left you can spend before you will either have to wait until you are paid or start dipping into your Freedom Fund.

So there is a built in pressure to not do anything dumb, make it to the next pay cycle, and keep you Escape Money growing.

Credit card statements read the other way. They go up. They just don't have the built in pressure of a number approaching zero to clear you mind and sway you from buying something stupid.

Credit cards will enter the story later...

We are now at the exciting next step. I have arbitrarily moved us from "How to Quit Your Job" to "How to Escape for a Year".

Keen readers will note that we haven't actually quit our job yet in the story. I hope I have been making it clear that the 'quitting' part of things is actually an active process of shoring up your role and your career before you pull the trigger and put in your notice. The actual act of 'quitting' is otherwise fairly simple if you have followed all the steps in Part 1.

So now we embark down the path of 'How to Escape' of which quitting your job is just a stop along the way.

But, we left the last edition on a high with 'How to Save', so we might as well work out how much we should save before quitting.

Note: I have emphasised this point and will continue to here - you still have not told anybody of your plans. Everything so far has been occurring in the background, within your own mind, in a private notebook.

And we continue to tick along quietly...for just a little longer.

So, for the next instalment of -

"How to Quit Your Job and Escape for a Year (and Why You Should...)"

Part 2 - How to Escape for a Year; Section a) - How Much to Save

This step is both very easy and impossible to get right. In fact, lets just settle on the fact that you will not be able to save the right amount of money. Once we accept that, we can start to predict how much we would like to save.

This will be an exercise in historic trends, nerdy spreadsheets and crowdsourced cost of living data.

Along with a fair amount of reading tea leaves, the entrails of slaughtered goats, flight patterns of crows and just plain old guessing.

An easy little start with planning would just be to save as much as you can for a few years. Aim for a huge number. Aim for $150,000 just for your escape year. Make it a huge, disgusting goal. Firstly because you will probably reach it if you are playing by these rules. Secondly, because if you miss, then you are probably still grossly overfunded for a year away. Thirdly because you might even have some money left over for when you come back.

But, we like to plan. So lets look at some numbers.

As a certified nerd (and young person) I kept track of my spending on some previous overseas trips.

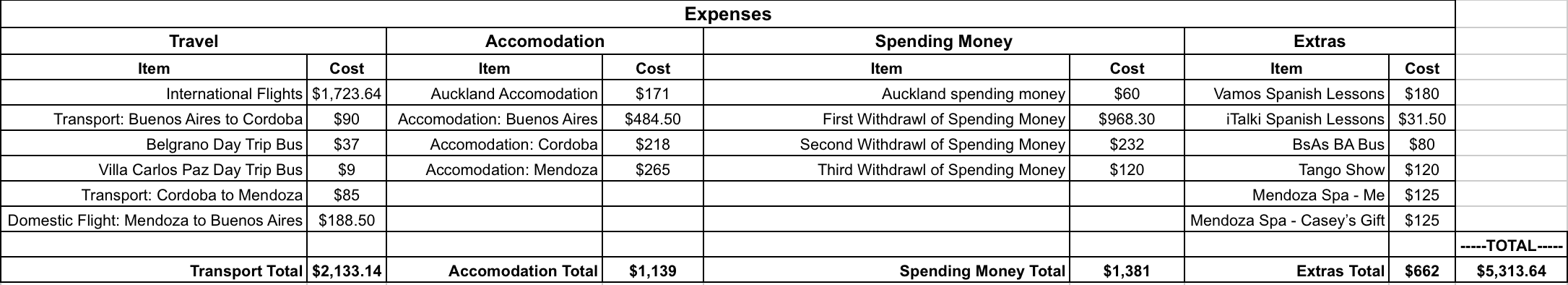

For example, a month in Argentina in 2017 - with Absolute Daily Expense of $178.96:

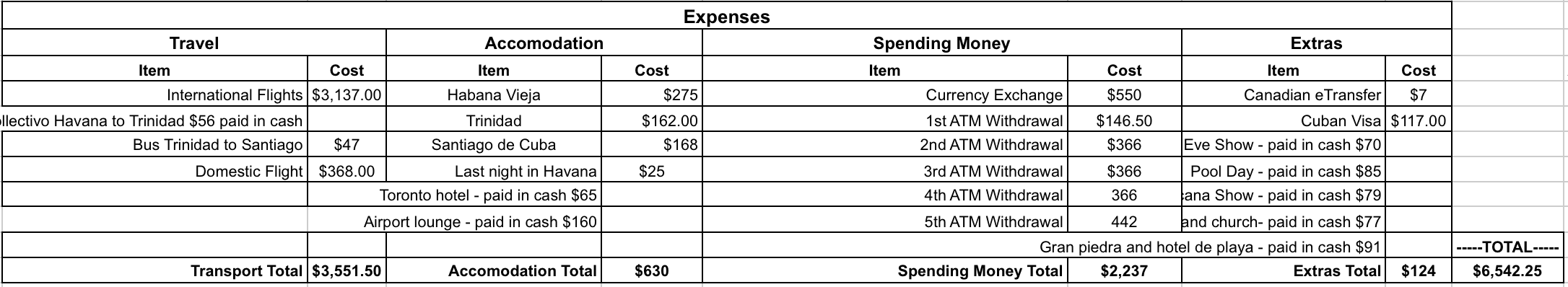

About four weeks in Cuba in 2018 - with Absolute Daily Expenses of $251.63:

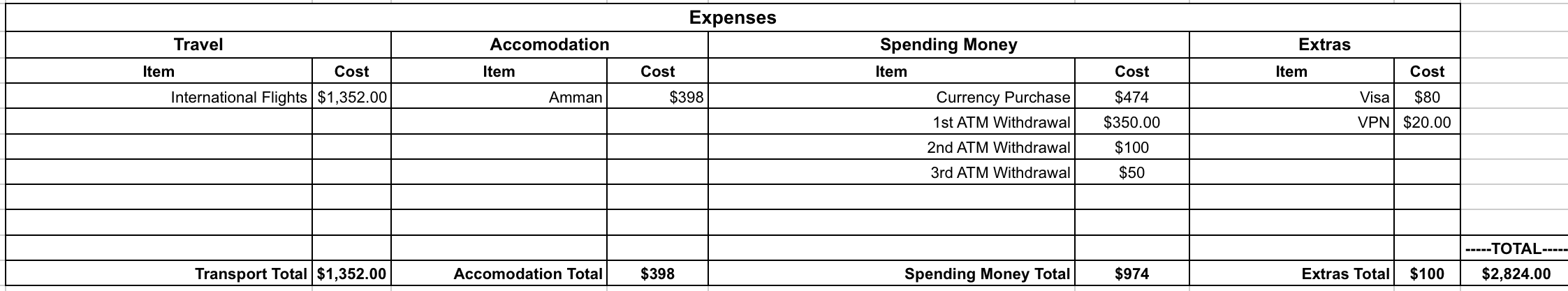

About 11 days in Jordan in 2018 - with Absolute Daily Expenses of $210.31:

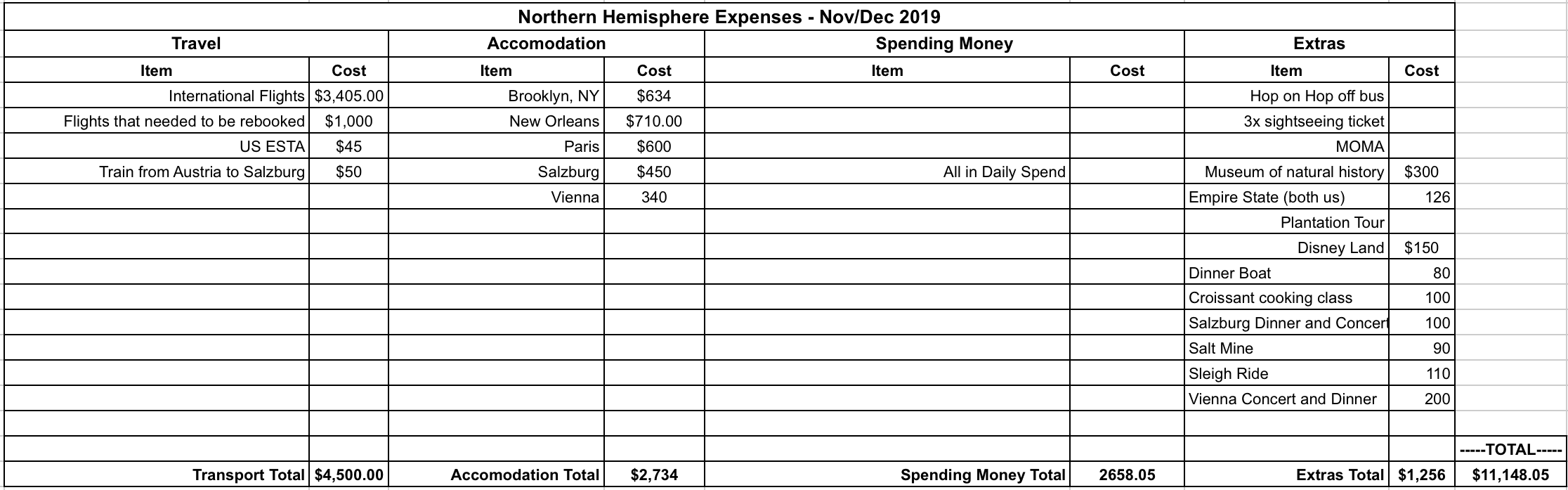

About a month in USA, France, Austria in 2019 - with Absolute Daily Expenses of $398.14:

By 'Absolute Daily Expenses' (ADE), I mean literally just the total cost of a trip divided by total days of the trip.

This means that shorter trips are skewed to be more expensive given international flights from Australia are a massive portion of the total. And trips with multiple international transit flights within a short holiday would reflect the same.

So with this I have some data from South America, Europe, and a smidge of The Middle East as well.

And then COVID happened... so there were no more numbers to track...

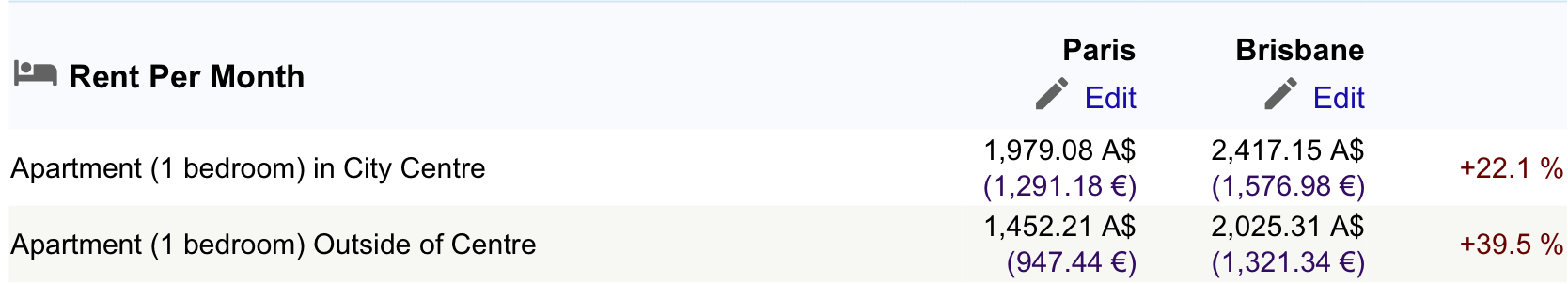

Then there is Numbeo, which is an excellent site that uses crowdsourced data to compare cost of living in cities, and can be useful for planning things like this.

For example - Brisbane v Paris:

So If I was looking to spend a month in Paris, I could pretty easily work out my expected costs by simply noting my living expenses for a month in Brisbane, applying whatever increase or decrease based on the Numbeo's comparison and saving accordingly.

(Note: It looks like it is cheaper to live in Paris than Brisbane. Wut...?)

In my case, Numbeo might be useful for planning some time in Asia, since I don't have much in the way of nerdy old spreadsheets to go off.

So let's say I want to spend 3 months in South America, 3 months in Europe, then 3 months coming back through Eastern Europe and Asia with the other 3 months spread across a bit of North America and Northern Africa along the way.

Well lets run the numbers:

- 3 Months South America - 90 days x $178.96 ADE= $16,106.4 - but this has to inflate up from 2017 numbers so is more like $18.442.15

- 3 Months Europe - 90 days x $398.14 ADE = 35,832.6 - but this has to inflate from 2019 numbers - so more like $39,622.06

- 3 Months Asia - Dunno, if I spend about $1000ish per week in Brisbane, Australia on stuff, then compare this to, oh I don't know, Ho Chi Minh City on Numbeo which is about 50-80% cheaper across the board, then lets say $500AUD per week in Ho Chi Minh City = $6000 for the three months; but then lets put some safety margin in there and say $10,000)

- 3 Months Miscellaneous - Let's meet in the middle of South America and Europe and say about $30,000

So my rough total would be: $98,064.21

Note: There is no way I will get this number right. Just putting it out there, ok.

Obvious limitations:

- I am extrapolating continent costs from country data. Naturally, I could plan every day of spending in any country I like across 365 days by comparing cost of living data of each respective location to my current spending. But that sounds boring.

- Unfortunately, I am married (Relax, just a joke...). So I need to save enough for two people.

- Fortunately, the marginal cost of adding a second traveller to a trip does not simply double the required savings. Naturally, you each need your own plane ticket, but you do not need your own hotel room etc.

- Also fortunately, my Absolute Daily Expenses from previous trips were calculated from door-to-door. From and to Australia - the most isolated (read: expensive) part of the world with respect to international flights. So I can have some confidence that I have over-exaggerated the required funds needed since the marginal cost of transiting from one South American town to the next, or one French village to another is not comparable to the cost of an international flight to and from Australia.

- Argentina is a basket case and none of their numbers are trustworthy...

- And finally, everything is more expensive since COVID happened and people are all travelleing again. So who knows what the final number will be.

But, just to be 'safe', why not aim for $120,000 for two people to escape for a year. To go forth and travel like we travel.

Also, remember, if you run out of money, you can just come home...

Part 2 - How to Escape For A Year; Section b) - Plan your Finish Date

We have worked out 'How Much to Save'. We used some spreadsheets and some crowdsourced cost of living data. And we came up with, probably, a fairly large number.

Now you have a goal savings amount (2-a) and a savings rate (1-e).

If you are able to put aside $1000 per fortnight of pay into your dedicated travel account, then your $104,000 saving goal will take four years.

Cold, unemotional math.

And then fiddling with the dials of savings rate x savings goal gives you different timelines.

For example, if you have calculated you need $97,5000 to travel and think you can put away $1250 per fortnight, then you are off and away in 3 years.

Your field might have a natural rhythm to hiring and change - calendar year, financial year, medical year, whatever.

So pick whichever convenient changeover time is closest to your calculated leave date.

Then congratulate yourself. You are set.

Enjoy the win.

Because remember, although you still haven’t told anybody, you have:

- An escape plan

- A funding plan

- A leave date

This is an awesome moment because you are the only person that knows it.

You have done something alone that is going to guarantee you something amazing.

And it is a secret that only you know.

Be proud of yourself for a minute.

Then go to the next step.

Part 2 - How to Escape For A Year; Section c) - Tell Everybody

You planned your finish date. You actually found a date that exists on a calendar after which you will have escaped. You celebrated.

But through all this: declaring to yourself the need to escape; working hard; building your career; looking honestly at your spending; planning saving strategies; then finally planing an end date -

- you still have not told anybody of your plans (save maybe your person, or your notebook).

Well now is the time. Tell everyone. Starting right now.

It is probably the most fun step. But also the most important:

- Partly you are reassuring yourself for your reasons for escape:

- No, you are not burnt out. No, you are not off to ‘eat, pray, love’ find yourself. No, this is not all some spontaneous emotional backlash to a bad breakup. And definitely no, you are not 'running away' from something.

- You have planned it. It is something that you just have to do. And you are going to do it.

Say all that out loud. To everyone.

2. Because by actually telling people, you are now accountable to the crowd and committed to your plan:

- You can’t back out now. Once you tell everyone, you would just look like a liar and a flake and a chicken if you don't go through with your escape.

- Telling people that you will be escaping then showing up for work after your 'escape date' is an absolute non starter. No way.

- What would you even say? You just chickened out? You thought it might be a bad career move?

- And the truth is that those middle management types would absolutely love to see you not escape. They would say things like, “yeah I’m glad you came around, we can’t all just run off when things get difficult” (as if things were actually difficult for you).

- And the other half of your colleagues who were secretly rooting for you to just go and crush an epic escape will be confirmed in their thinking that there is no way out.

So this is why you tell everyone. You have sunk a cost. You have to escape.

3. Telling people is fun:

- Take my word for it.

- Telling people that no, you won't be moving on to the next department or hospital or site in the next employment year; rather you will be heading to South America - is an amazing feeling.

- And you get to experience that feeling every time you tell someone.

It is important to remember that you have not quit yet. You had to tell everybody first...including your boss.

Note: You are now likely a few years into you career at this point, so no one will think that you were just lying at your original job interview when you said you were committed to your role. Because you weren't lying. And you were committed to the role.

But those employment conversations are about to come up.

Part 2 - How to Escape For A Year; Section d) - Quit Your Job With Options

You have planned, prepared and saved for your escape. And most importantly, now you have told everyone.

To Be Very Clear: You have started telling everyone before you have sorted things with your employer. This is important. If you go to your employer first and have a quiet word about taking time off, there is a reasonable chance that you will be convinced to "stick around for another year" before you leave for "career progression" purposes or because you "are just hitting your strides in a leadership position". All of that is probably true, because you are an excellent employee. Telling everyone first, sinking cost into your plan, anneals you from these tender offers from your employer.

You are leaving.

You have been having a wonderful time telling everyone in the tea room of your escape plans.

Now, for the return plan.

The return plan is the end result of: getting a good job, not telling anybody, doing good work, building relationships, and then telling everybody that you are leaving.

The conversation with your employer should be simple:

“Hey (boss with hiring powers who I can address by first name on a casual basis because I am a fantastic employee who does good work), I am leaving next year to travel the world. Can I have my job when I come back from my escape?”

That’s it.

They will say yes.

It may even be possible for you to literally keep your job but just be on leave. So you keep whatever benefits that allows. They will say yes.

An Example: I accrued about 10 weeks of leave before I left. I negotiated that I would be paid out my leave at half pay (for 20 weeks) then have the remainder of my escape year as leave without pay. So I still have an income (as I write this) and have a return plan back into the job that I like (presumably when I run out of money).

But also say to your boss:

“If I have to apply for my job when I come back then that is completely fine. I totally understand.”

If you have to re-apply for your own job, your boss (who you know by first name and can speak to casually) will spend the interview enthralled by your tales of escape and jealously wishing it was them. You will get the job. You have an amazing CV. You worked for a few years where you did good work and made a career for yourself. Anyone you worked with would write you any reference you want because you built relationships. And you will have documentary proof that you are sensible and hardworking because you saved a 'War Chest' to escape.

Most Importantly: If, after all this, your employer does not say yes, then this conversation rapidly becomes one of resignation. Because if your employer cannot see that they have an excellent employee who has independently prepared an a amazing escape and still wants to come back to their job, then it is clear they will never let you go.

Ever.

So get out.

Part 2 - How to Escape For A Year; Section e) - Pity the Doubters and be Pessimistic

You have quit your job with options. You have now told everybody, including your boss.

So you have a return plan - either:

- You keep you current job and cash out some leave

- You officially end your employment with the knowledge that you will just apply for your job when you come back

- Or you are free to do whatever you want because you resigned and have no intentions of returning to that job (even though you will return with an excellent CV and all the best stories...).

There are no numbers or calculations in this instalment, just some fairly strong opinions...

It's Time to be Pessimistic -

If you don’t go now (your departure date), then you will never go.

The middle management types will drag you down to the depths of whatever office hell they inhabit and make you sacrifice a goat to the honour and glory of all management drones or some weird shit.

And of course then you are the person who put off a holiday. So you will just put off the next departure date so you can lock in that promotion first.

Or maybe you will just try to get on to that training program before you escape for a year. Oh you didn’t get on? Just apply next year and take your little holiday afterwards.

Oh you are thinking about kids? Amazing. That won't interfere with your plans at all...

Oh how exciting, you are buying a house, Yeah in this market, you would be mad not to.

Oh of course, lets go out for brunch....

Fuck that.

Ignore and Pity the Doubters -

You are crushing it in your career. You have a stack of cash.

You are ready to leave at the next employment changeover. Everybody knows it. They are asking you where you are going first. So is your boss, who has completely guaranteed you your sweet job on your return.

And there will still be some middle management type that says, “oh wow, I would be careful you know. Have you thought about how this might affect things when you return?”

This is easy - just ask them how their escape affected their employment prospects after they returned from their trip.

**Crickets**

They won’t say a fucking thing. Because they never left. Because they told someone when they first thought of travelling and some middle management type squashed it out of them when the idea was just a seed.

Or they weren’t pessimistic enough.

Or they are just middle management types...

Ignore them. Pity them.

Part 2 - How to Escape For A Year; Section d) - Passport Interlude

For goodness sake make sure you have a valid passport.

A passport with years left until expiry.

Just do this now. Even if your timeline means you will be leaving on your trip in 2 years or (hopefully not) 2 months.

For the Australians: Go HERE and begin.

Otherwise, search "*your country* passport application" and crack on.

Part 2 - How to Escape For A Year; Section e) - Double Down

You have a departure date. You have 'quit' your job. And everybody knows it.

Now is the time to double down on your savings.

If you feel like it, aim for a higher fortnightly savings rate by cutting back on splurges and indulgences.

Or, if you are like me, just stay the path with those automatic bank transfers from every pay cycle and continue to ignore (read: don't touch) your growing War Chest.

Other strategies:

- Sell that gym set you barely use - Facebook marketplace

- Sell off those Lego sets to the young family next door - Facebook or word of mouth

- Sell off your collection of high heels and handbags - Facebook market place

Then closer to the departure date:

- Sell your car - CarSales

(The car question could go either way. I sold mine and my wife kept hers - it was the better car and is just being turned over once a week. We will figure out the transport issues after the Escape...)

Then start planning to leave your residence. I happened to be renting on a fairly flexible timeline, so simply informed the landlord that I would not be renewing after a set date.

It is harder for me to offer advice to those who own their home. Naturally tenants under a rental agency is probably preferable to selling. But you will need to do the maths of mortgage payments, less rental, into your budgeting. Most will be negatively geared so would need to plan to cover the difference in mortgage payments from their War Chest savings, unfortunately. But, it can be planned for. It can be done.

Part 2 - How to Escape For A Year; Section f) - Insurance

Travel insurance is absolutely a necessity.

You absolutely do not want to know the costs of an American Intensive Care admission followed by international aeromedical retrieval home.

And some countries may demand proof of insurance before you enter.

So just buck up and pay it. Unfortunately, since your escape will be longer than the usual 4 week holiday, the prices will be reflective of your longer trip.

Before you go too far - if you are in a field that already requires professional indemnity insurance, check if they also offer travel insurance.

Check if your local health insurer has a travel insurance policy that can be added on.

I was able to get (very) cheap travel insurance for my (and my wife's) first six months of travel (which would get me through the US...) through my medical indemnity provider. Then I will purchase another batch (that won't need to cover the US) at that 6 month mark.

Secondly, if you already have a credit card (or not yet - this will come up below), you may be able to get travel insurance through the credit company as well.

Then do a google and have a thorough look at the comparisons.

Pay particular attention to "you are not covered for mopeds" or whatever particular activities you think you might get up to *cough* Bali *cough*.

Get travel insurance.

Part 2 - How to Escape For A Year; Section g) - Vaccines and Medicines

Similar to above - you do not want to get deathly unwell from a vaccine preventable illness while in Bolivia...

The TL;DR for this section = google "travel medicine clinic" and just book an appointment. Do that now.

Some common recommended*** vaccines:

- Yellow Fever - you may be required to show proof of Yellow Fever vaccination to enter some countries

- Diptheria, Tetanus and Pertussis - check when you had your last and get a booster if needed

- Cholera

- Japanese Encephalitis - another one you may need to show proof of

- Typhoid

- Hepatitis A Virus

- Hepatitis B Virus - check serology prior, you may already have immunity from childhood vaccinations

- Rabies - just to be clear, if you are bitten by a rabid animal, you need to urgently have immunoglobulin injected in to the bite site irrespective of vaccination status - something that is famously painful. And if it all goes bad and that is not sufficient in the unvaccinated patient, Rabies has a 0% survival rate... Get your vaccines and don't pet any scruffy animals...

- Have a Malaria plan - daily Doxycycline is annoying and no one remembers to do it for the full course. We have used Malarone (Atovaquone and Proguanil Hydrochloride) 3 Day Regime - four tablets per day for the three days prior to travel to malaria regions, which gives you 25-28 days of coverage. Simple.

From a medication*** point of view, my recommendations would be:

- Your Malarone course

- For bad ear, nose, throat, skin infections (also covers chest) - Cephalexin

- Travellers diarrhoea and also chest - Azithromycin

- More for travellers diarrhoea - Norfloxacin

- For gastrointestinal contest** - Loperamide and Ondansetron (wafers or disintegrating tablets)

- General - Paracetamol and Ibuprofen

** This is a nice way of saying "concurrent diarrhoea and vomiting" - the wafers are important here since you don't need to swallow them (since you are vomiting)...

*** Blah blah blah this is not medical advice. Go and see your GP.

Part 2 - How to Escape For A Year; Section h) - Plan a Route, If You Want

This is honestly one of the most fun aspects of travelling. Planning is fun.

Save the cool travel things you see on Instagram. Note down the cities.

Scroll around Google Maps.

For Australians, there is fortunately very little you need to do with respect to Visas for travel to most of the world. Almost everywhere allows visa free stay of at least 30 days, sometimes up to 180 days.

A couple of points to note:

- Almost the entirety of South America is open to us, except for Chile - so if you are keen on Chile, get cracking on their weird list of Visa requirements.

- The US has a bizarrely intense (but fairly simple) application for Visa Free entry - google "ESTA US", fill out the form and pay the fee. It is usually approved within a day. BUT YOU ABSOLUTELY NEED TO HAVE DONE IT PRIOR TO ARRIVAL.

- We can do 90 days in the Schengen Area in any 180 day period - just use this calculator thing to work out how your time is calculated.

Otherwise, just have a poke around Google Maps, let your mind wander, and compare the countries you like to the 'Visas' section of that country's profile on Smartraveller.

Oh and a lot of immigration authorities will require proof of onward travel. Some South American airlines will even need proof of online travel a couple of countries ahead (looking at you, Avianca). If you haven't booked that far ahead while you are on the road, just go to onwardticket.com while you are standing in line and book a real ticket for like $20 (that you can wave at the immigration officer) that automatically cancels within 48 hours.

Part 2 - How to Escape For A Year; Section i) - Ditch Your Stuff

Let's jump forward a little bit.

You are weeks away from your departure. You have your War Chest ready to go. You have probably booked your first flights and accomodation.

Things are getting exciting.

You have already sold what you can sell. But you probably have the usual furniture and other household items lingering in your house.

And if you are like me, you are probably going to try and move out in the week or two prior to your departure, and just couch surf with your family with your bags ready to go.

I can tell you that one of the most satisfying things you can do is gather all your crappy second hand furniture and assorted rubbish that fills your residence, pile it up in the front yard, and call a service like 1800 Got Junk and have someone take it all away.

Different regions have different services, just do a google.

It is oh so satisfying.

Part 2 - How to Escape For A Year; Section j) - Finance

From the above steps, you have your War Chest in some account that is hopefully not linked to an easily accessible debit card.

I would recommend a few things here, practically all of which are in the context of avoiding theft and fraud:

- Use some sort of debit card for spending oversease that is not linked to your War Chest account - I have an ING card that I can use for day to day transactions that is not linked to my UBank War Chest account. So if my ING Card or wallet is stolen, I can cancel it and my UBank War Chest is safe.

- Consider a Credit Card*** - This is where the credit card comes in. I have been using an American Express Platinum (Velocity Frequent Flyer) for most of my purchases during my Escape Year so far. I have linked it to PayPal and my Virgin Velocity Points account. This gives me safety (it's not my money, it's the credit company's, so if I am defrauded out of some purchase, I can just say "soz you deal with it" to American Express) and I can accrue points to my Virgin Velocity account. And it gives me a redundancy of Travel Insurance for all travel that I book with it - which is...all my travel. I also set quite a high available credit in the case of emergencies that I need to quickly spend my way out of.

- Online/International Platforms - Revolut and Wise are both clever international banking apps for which you can be issued digital, single use and physical debit cards with the ability to store, spend, send and receive in multiple currencies across international banking systems. They can come in handy with bookings that require a direct deposit (eg AUD to USD into an Ecuadorian bank) and can also give an extra layer of security (single use and cancel-ability) with their cards.

- PayPal - I have PayPal set as my default funding option for payments on Uber, Kayak, AirBnB, Booking.com etc

*** Blah blah blah this is not financial advice...

Part 2 - How to Escape For A Year; Section k) - Apps and Workflow

Simplicity and ease is what we are going for when booking accomodation, keeping track of flights, sorting transport etc.

Everyone has a smartphone.

And there are apps for everything.

So here is the "tech stack" of travel apps I use:

- Uber - Available almost everywhere, you don't need mobile data for it to work - you can order from the wifi in the cafe and get in.

- Kayak - For all flight bookings, it is an excellent tool to search for and pay for flights since it aggregates flights from heaps of different providers. But it is actually not the best to store all your bookings so;

- Any Email App - I will 'flag' all my flight confirmation emails (from Kayak) such that my 'flagged' folder is an ascending time stamped folder of flight (and accomodation) bookings. I would even go so far as to suggest using a separate email acount for all these confirmation emails you will be receiving - so either dedicate an account you already have or just open a *yourname*travel(at)gmail(dot)com account or something similar.

- Skiplagged - Second choice for flight searches, better for domestic flights.

- AirBnB - better for longer stays in safer locations - tick the filters of 'instant book, 'self check-in' and 'free cancellation'.

- Booking.com - better for hotels and 'AirBnB-like' accomodation that won't include ridiculous cleaning fees or host requirements.

- Busbud - Like Kayak, but for buses. Good in South America.

- Uber Eats - Works in most places.

- Rappi and Pedidos Ya - South American specific food delivery.

- Miscellaneous flight aggregators and Airline-specific apps - MyTrip, Kiwi.com, LATAM, AirNZ etc - I still book flights from Kayak but then can open boarding passes in the specific carrier or aggregator's app.

- Google translate - Not for speech, really just for translating menus.

- Google Maps - So useful. Download offline maps for wherever you are.

And I just keep them all in one folder on my phone's home screen.

I have basically all of them linked to PayPal (which is in turned funded by Credit Card) so I can earn points on all travel related purchases (which go to my Virgin Velocity account).

Easy.

Part 2 - How to Escape For A Year; Section l) - Pack Your Bags

I encourage everyone to only ever take one bag, a simple backpack, regardless of their travel destination or length.

(I can nerd out on backpacks, style, material, pockets etc for hours - but this is not the time)

I think this gives the best balance of security and simplicity when travelling.

This is a little extreme for some so here is as far as I'll go with recommendations for bag choice:

Carry-On Only

So you get a backpack and maybe a roller suitcase thing that fits into the overhead compartment. That's it.

No Checked Baggage:

- Checked baggage can get lost (bag in Dusseldorf, you in Sao Paulo).

- It can be damaged - you have no control over the care taken by baggage handlers...

- It means you have packed too much...

- It will be heavier than the sun.

- It will be expensive - checked baggae can double (or triple) the total cost of your flight (especially with small local carriers).

- And it is just a big shiny parcel of "rob me" when you are dragging it along the sand tracks of Gili Trawangan, trying to get to your hotel, after it was soaked trying to get it off the boat (flashbacks...).

Don't worry about not having enough clothes. Do you really only wear your clothes once at home before throwing them away? Or do you wash them? Reminder - the rest of the world has washing machines...

Don't worry about wearing the same clothes over and over. No one cares. The people that actually care what you are weaing are knobheads. And you get to change those people, and your city, whenever you want. No one cares what you wear. Just be comfortable and enjoy yourself.

By the way, just as there are washing machines outside your home country, there are also clothes stores. You are allowed to thow away, buy different clothes, buy a jacket if you travel somewhere cold, buy a poncho in Peru, throw out your gross Amazon Jungle shoes etc etc.

I offer no packing lists here (maybe another time), they are all over the internet.

Lastly, I'll just remind you of what seems to be a law of nature: Whatever bag you decide to bring, you will fill.

Part 2 - How to Escape For A Year; Section m) - Just Go

Congratulations.

You've made it.

You are walking down the gate to your plane.

Get some sleep on that long haul.

And please don't feel stressed about spending the money that you worked so hard to save. This is the whole point.

That money is going to buy you time, space, experiences, new outlooks and, potentially, a new you.

If you run out of money, you will just come home. Not the end of the world.

Do whatever you want to do. Enjoy it.

Part 3 - Why You Should; Section a) - Because Otherwise You Won't

If not now, then when?

All the way back at the start, we saw that there were going to be people that tried to convince you out of this - who had never escaped themselves. Because their lives got in the way...of living.

You could be pregnant next year. Then sign up to a massive mortgage.

And then a cancer diagnosis the year after that.

What about in retirement? Well, by then osteoarthritis will have a vote in your plans... So will your bad back. What about your grandkids and babysitting duties? Or the fact that you are quite comfortable in your retirement and don't really want to go and hike around Patagonia. Things change.

Part 3 - Why You Should; Section b) - Because It's Fun, That's Why

New sights. New sounds. New smells. New people. New cultures.

Places you'll love. Places you'll hate. Places you will plan on coming back to.

You'll have the time of your life. And you will meet new friends along the way.

I can even guarantee you'll have fun. Because the whole point of you working so hard, saving your War Chest is that if you find yourself in a crappy boring little town, you are free to book a ticket and move on to somewhere else.

And when you find that somewhere else, feel free to extend your stay by a week, or a month. End enjoy it.

Part 3 - Why You Should; Section c) - Become Smarter

This is just a personal soapbox of mine.

I think there are only two ways to become functionally more intelligent:

- Reading for pleasure.

- International travel.

By functionally more intelligent, I don't mean being able to rotate shapes in space (among other things) like on an IQ test. Rather I mean being able to draw on a varied set of experiences in conversation that you can apply to day-to-day life. So that even in banal, boring situations, you'll have a diversity of experience from which to draw perspective and insight.

Reading 5 books on one topic that you enjoy probably puts you in the most knowledgable 1% of people on earth wihthin that domain.

Just as travelling the length of South America will make you functionally smarter in a plethora of domains: Culture, Finance, Religion, Politics, Dating (if you want) and on and on...

The lessons won't fade. Once you've learned these things, you are smarter for ever. And you will see things differently.

Part 3 - Why You Should; Section d) - Your Career

Now we come to the part that I have to speculate on just a little.

Since I am mid-Escape at time of writing, I can't know for sure how my career will be affected.

So here is my speculation:

- This will not hurt my career.

- The Escape will help my career.

I think part of the reason that people are worried about this point in particular is that they rarely have professional mentors who have taken their own plunge to travel the world.

So there is a bias - of all those people in your field who have succeeded, none of them took a year off to escape. Therefore, taking a year off precludes you from succeeding. Right?

I am convinced this is a reasoning error. This is just combination of availability and selection bias.

Since most people overall (ie at a population level) will never Escape, we could expect these non-escapers to populate all the success stories in any given field....AND ALL THE FAILURES! Like that loser you went to high school with who is in prison - yep, he also never travelled the world...

Rather, we need to know what happened to the people that did Escape. You may not think there are any in your field, but I promise you they are out there. And they tend to be the alternative thinkers, the misfits and those who strongly value work-life balance while quietly succeeding.

And if you have made it this far, they were the ones who, when you started telling everyone your plan back in step 2-c, responded with a simple "yep, do it, that will be awesome" and, with minimal prompting, would then go on to tell you a bunch of awesome stories from when they did it themselves.

As for my speculation that your Escape will help your career. Well, you've taken a year out of the workforce that you expect to be in for 40 years. Not a particularly significant amount of time - you would not expect to de-skill to zero. And you will return with an unfair advantage of new experiences, skills and ideas.

Caped losses, uncapped gains.

A Post-Script:

If you have read along this far - thank you for sticking with me.

And if you have made it this far - I hope you are enjoying your travels...

And for you all, I would very much like to hear your feedback. What suggestions or corrections should I consider?